In the below step by step demonstration we will go through the process of Setting Up and Executing Fixed Price Project with Percentage Completion method.

The scenario here is for a company who is providing Commercial Paint Services. The consumption will include Paint, Hours(Labor Cost) and Expenses (Rental).

SO HERE WE GO !!

Project Setup

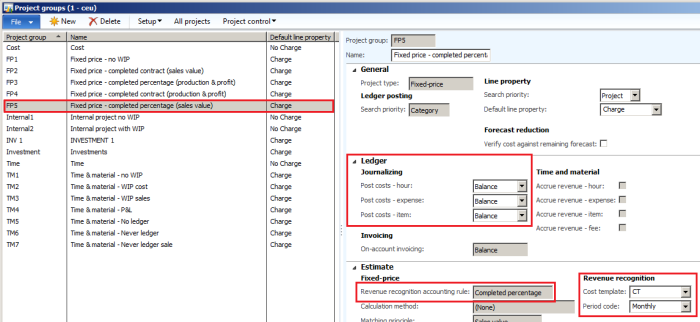

1. Project Groups

Project groups define how the system processes the ledger postings of the project types. Each project belongs to a single project group. Project groups control the following:

- Posting profiles to the general ledger

- Project WIP

- Reports & Analysis on basis of Groups

At least one project management and accounting group must be set up because the project group is mandatory when you create a new project.

Note: In Microsoft Demo Data you can use the Legal Entity : USSI, as this Legal Entity is already configured with different project groups and pre-req setups.

In this scenario we will use Fixed Price Project ‘Fixed-price projects are for projects that are invoiced according to a billing schedule based on the project contract. Revenue for a fixed-price project can be posted according to the completed contract method or according

to the completed percentage method’

Further, a fixed-price project with completed percentage includes the following process

flow.

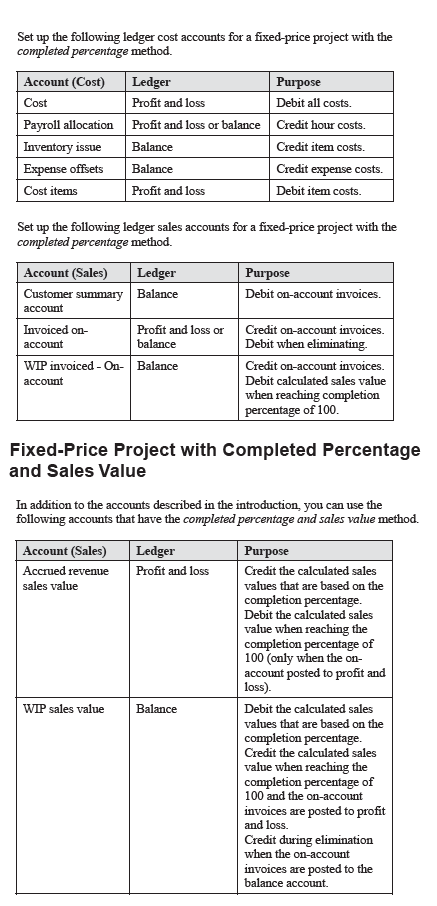

1.During the project, costs are recorded into either work in progress (WIP) balance

accounts or profit and loss accounts. If costs are posted initially to balance

accounts, the costs are moved to profit and loss accounts during the estimate

process.

2.You must decide between balance accounts or profit and loss accounts for onaccount

(milestone) invoicing.

- • On-account transactions post to profit and loss accounts and are subtracted from any revenue to be recognized by the estimation process. Only the revenue adjustments are accrued when WIP is posted, and later when the offset is eliminated.

- • On-account transactions post to balance accounts and are not considered when revenue is recognized during the estimation process. The accrued revenue and WIP values are calculated and posted with the project estimates. When the estimate project is eliminated all WIP transactions are offset and the revenue remains on the accrued revenue sales value account.

In both setup types, the balance accounts clear when the estimates are eliminated.

If on-account invoices are set up to post to balance accounts, revenue does not

post to a project until the estimate function is run. This means a project profit and

loss statement that is run before any estimates are posted shows a negative profit

because there are costs without revenue.

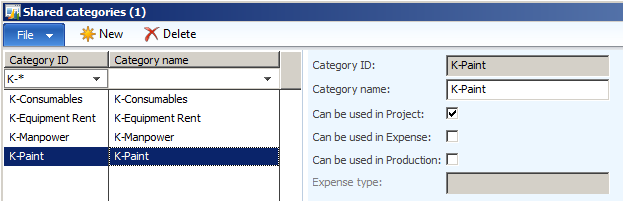

2. Shared Categories

To make it easier for companies to categorize expenditures, categories are shared among the Expense management, Production control, and Project management and accounting modules. In addition, categories are shared between legal entities.

Open Project management and accounting > Setup > Categories > Shared Categories.

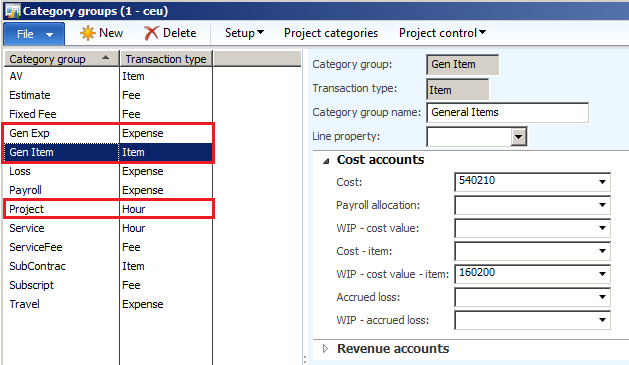

3. Category Groups

You can use category groups to share properties (primarily posting profiles) between related categories. There must be at least one category group for each transaction type and each project category is assigned a group. Together, the project groups, project categories, and category groups define the posting specifications in the Project management and accounting module.

To open the Category groups form, open Project management and accounting > Setup > Categories > Category groups.

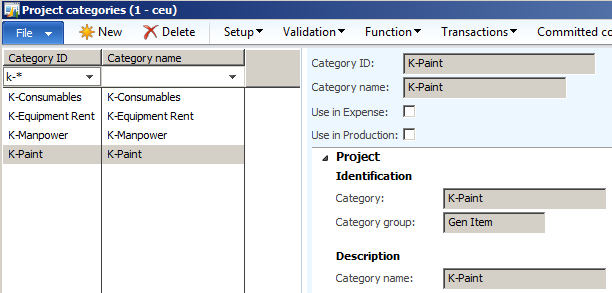

4. Project Categories

Once you have defined a shared category and category group, you can configure a category for use within Project management and accounting transactions.

To open the Project categories form, open Project management and accounting > Setup > Categories > Project categories.

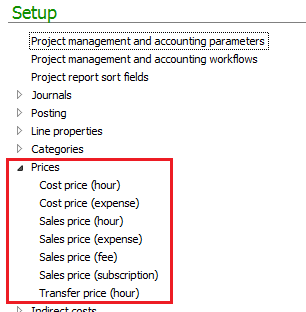

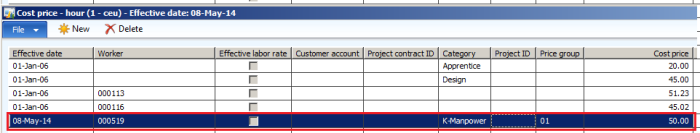

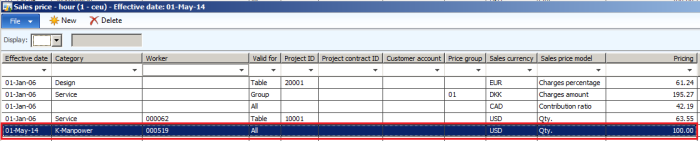

5. Cost Price Setup

Cost and Sales Price can be attached with respective categories (workers).

Project management and accounting > Setup > Prices

Cost price for Hours (worker)

Sales price for Hours (worker)

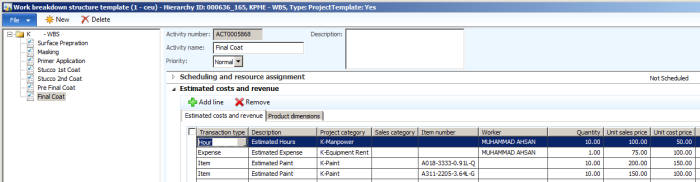

6. WBS

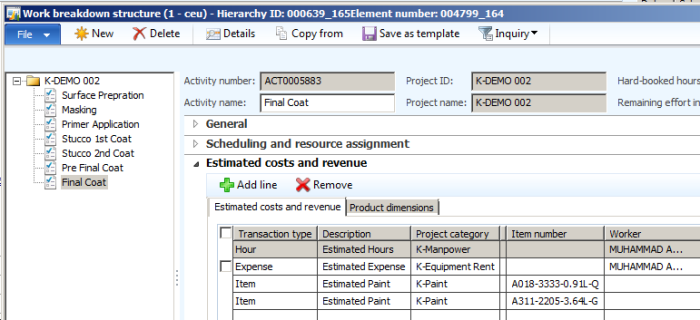

WBS can be defined as a template and Estimation (forecast) can be incorporated for Hours, Expense, Consumable and Items. This template can then be attached with projects.

Project management and accounting > Setup > Activities > WBS templates

Project Execution

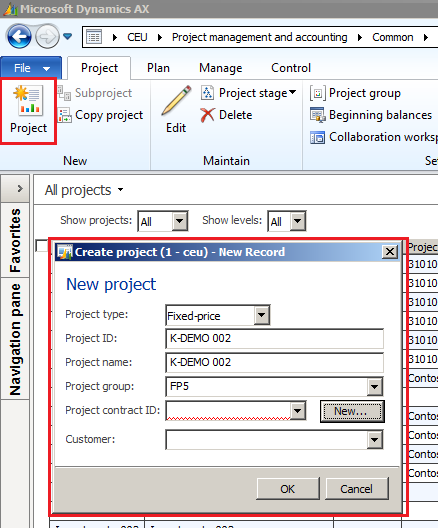

1. Create Project

Create a new Project from Project Management and Accounting.

Select the Project Type as Fixed-Price, Enter the Project ID and Name, select the Project Group.

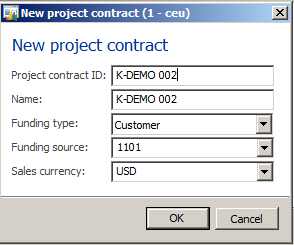

Then click on New on the Project Contract line.

Enter the Contract ID and Name, select funding as Customer and select the Customer for which the contract and project is to be done.

2. Create WBS

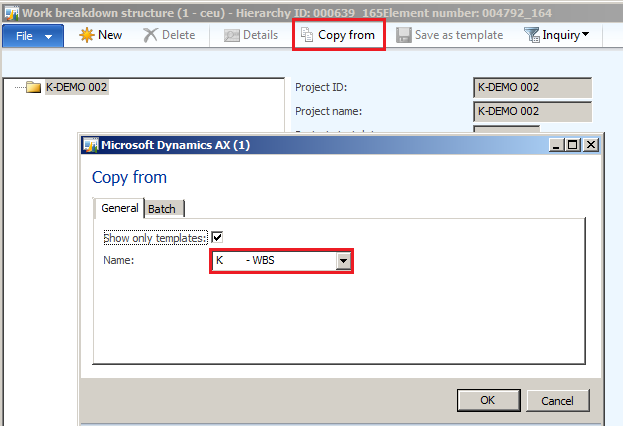

The WBS created in the setup will be copied to this project by clicking copy from and then selecting the WBS from dropdown.

The WBS is copied

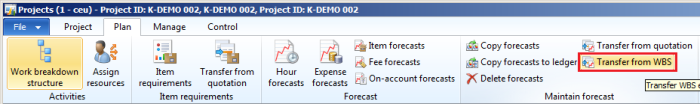

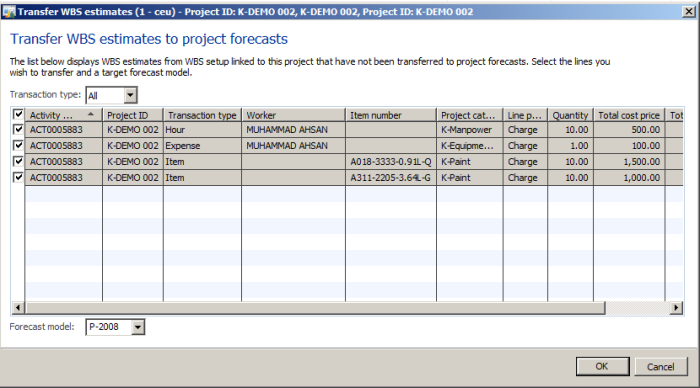

3. Transfer forecast from WBS

The forecast can be copied from the WBS. Click Transfer from WBS as highlighted under and select the Transaction Types that need to be copied.

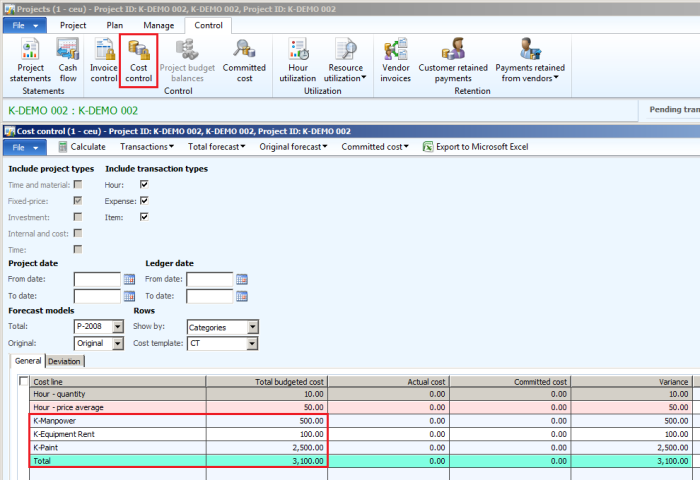

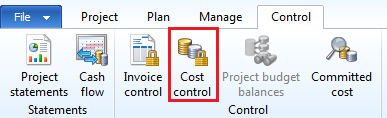

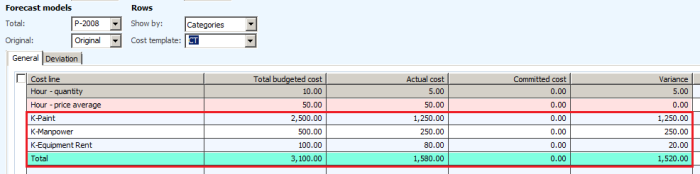

4. Cost Control inquiry before Project Start

User can generate the Cost Control to review the Forecasted Categories Cost

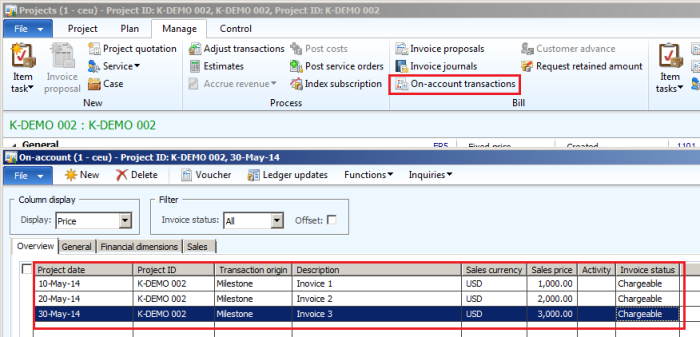

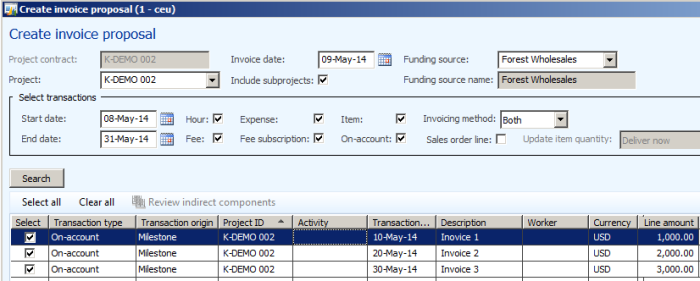

5. Create On Account Invoices

Invoicing can be schedule by using On Account functionality. The invoices created can be posted later by using invoice proposals. For fixed-price projects, on-account invoices should be used for milestone billing. For example, a customer may want to set up scheduled payments based on the progress of a fixed-price project.

Open Project management and accounting > Common > Projects > All projects.

On the Action Pane, select the Manage tab. From the Bill group, click On-account transactions.

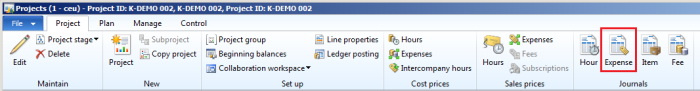

6. Enter Project Transaction

Enter the project actual transactions as the project proceeds.

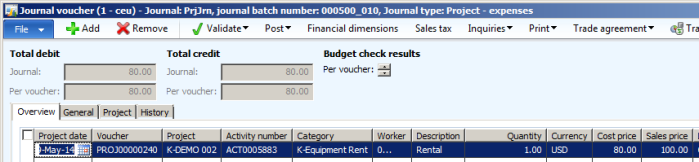

1.Expense transaction will be entered from the Expense Journal

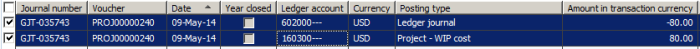

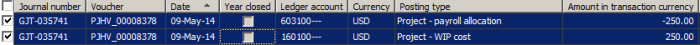

Vouchers

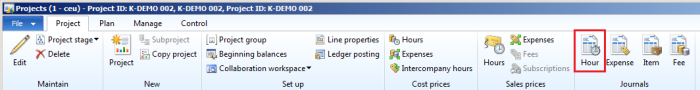

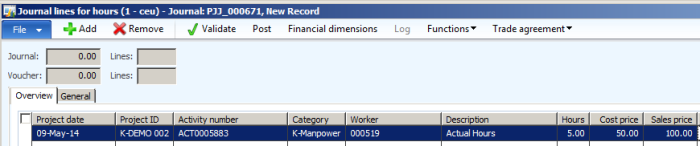

2.Hour transaction will be entered from the Hour Journal

Vouchers

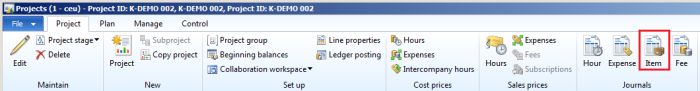

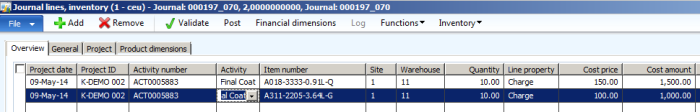

3.Item/Consumable transactions will be entered from Item Journal

7. Cost Control after actual transactions

The cost control inquiry can be taken at any stage of Project execution that will show the Forecasted VS Actual.

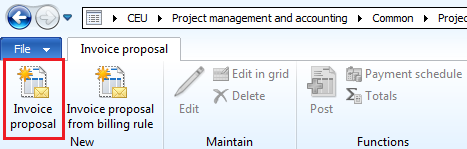

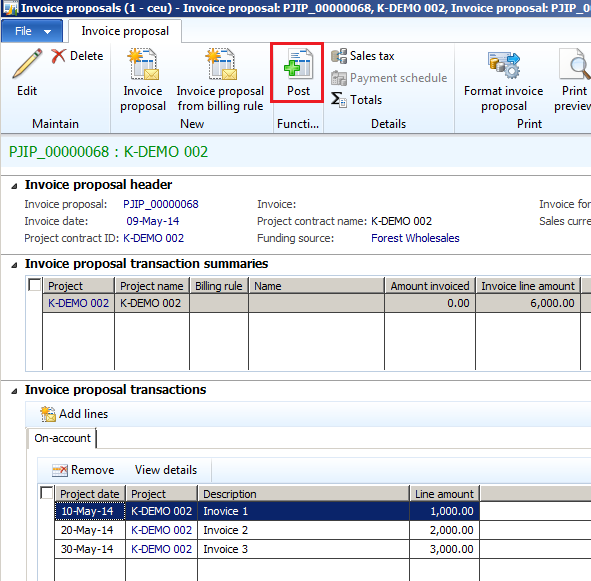

8. Create and Post Invoice Proposals

The On Account invoices that were created earlier can be posted.

The criteria can be given based on date range. If the date range includes two On Account invoices the system will show those two invoices.

Post the Invoices

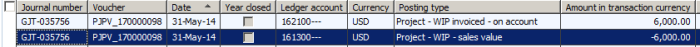

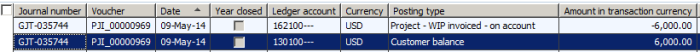

Vouchers

9. Project Statements after Invoicing

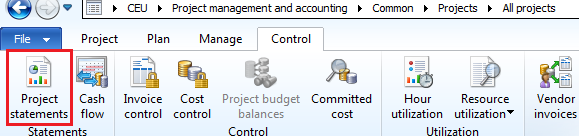

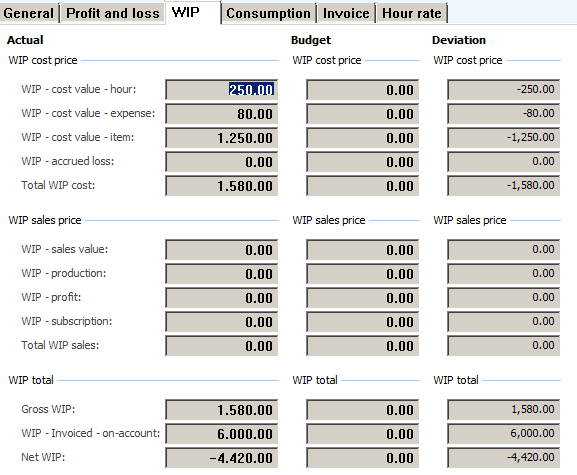

The WIP can be tracked from Project Accounting > Project > Control > Project Statements

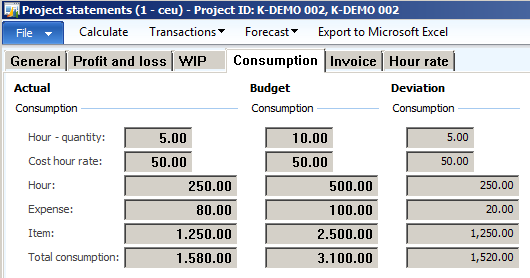

The Consumption can be tracked from Project Accounting > Project > Control > Project Statements

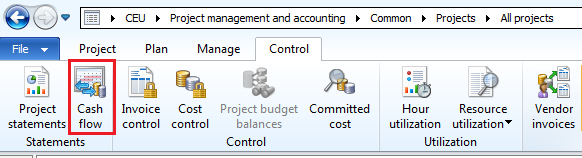

10.Project Cash flow

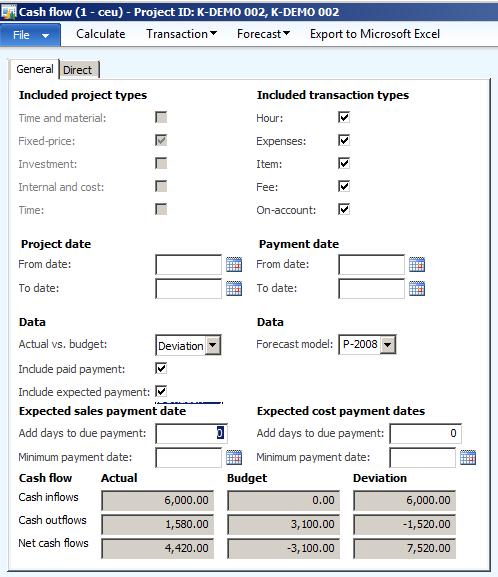

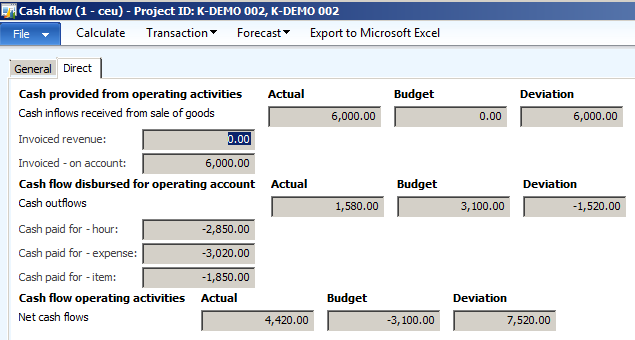

The cash flow can be tracked from Project Accounting > Project > Control > Cash flow

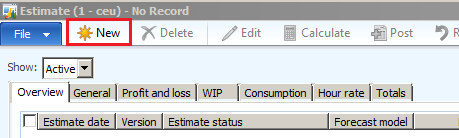

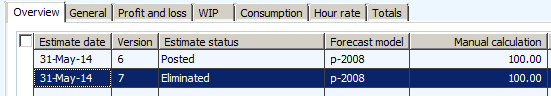

11.Project Estimation

The progress of the project must be monitored during its life span.

To do this in Microsoft Dynamics AX, use the estimate.

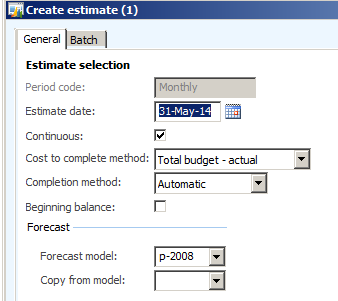

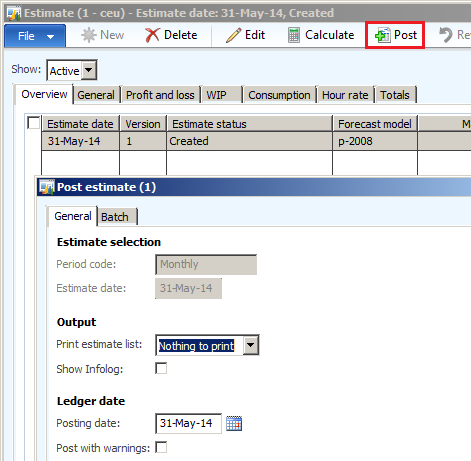

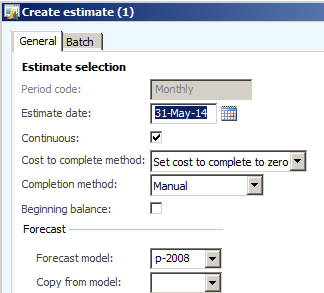

Create an estimate, select the date and Estimation Parameters.

1.Cost to complete method

Total budget – Actual: This method requires a forecast model to compare forecasted transactions against actual costs to determine a cost to complete.

2.Completion Method

Automatic: Percentage is generated automatically based on the total estimate.

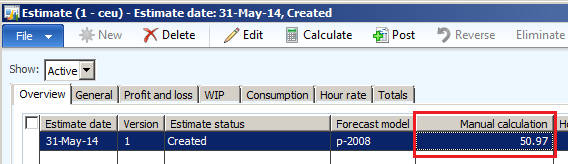

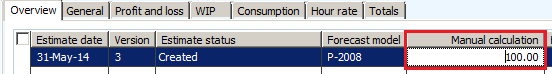

The value 50.97 is the % of Project Completion based on the Forecasts and Actual Transactions.

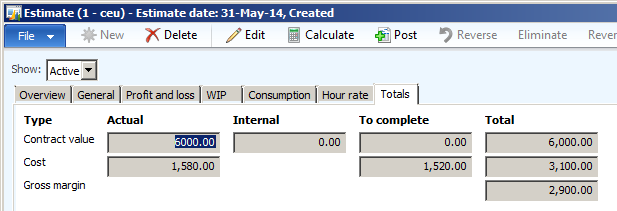

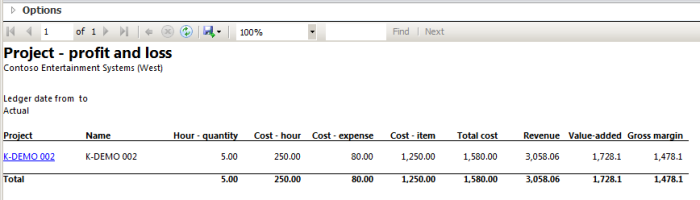

The Total TAB shows

- The Invoiced Value 6000 and Actual Cost Incurred 1580.

- 1520 is the remaining cost to complete the Project, based on (Forecasted – Actuals)

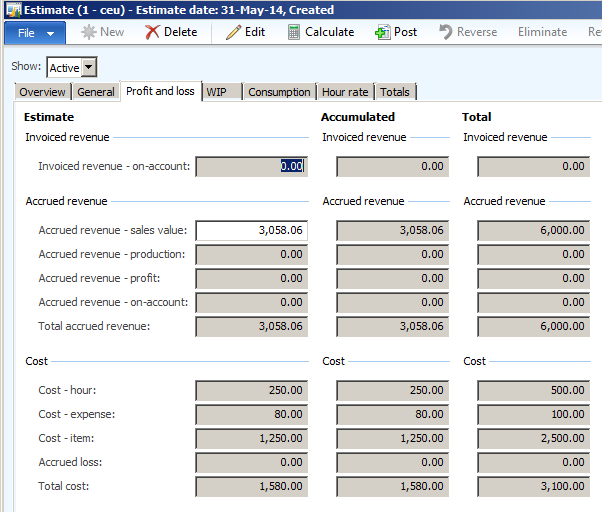

The Accrued Revenue calculated by the system is 3058.06. This value is based on % of Project Completed and Invoiced Amount (6000 * 50.97%)

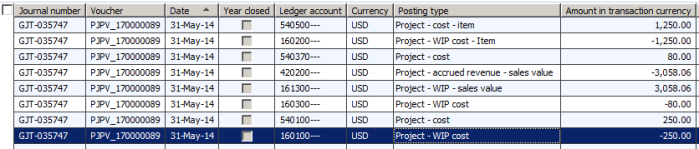

Posting the Estimation will generate the accrued revenue (sales value). Revenue is calculated based on the completion percentage.

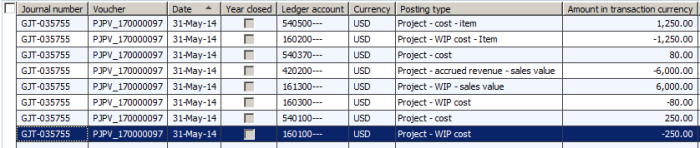

Vouchers on Posting Estimation when the Project is 50.97 % complete

Eliminating the Estimate Project and Finishing the Project

The final step in the estimate process is to eliminate the estimate project and end the fixed-price project when the percentage of completion reaches 100 percent. When the elimination is run: If a fixed-price project with completed percentage is run the accruals are removed from the profit and loss accounts.

12.Project Statement after posting estimate

13.Project Statement after posting estimate

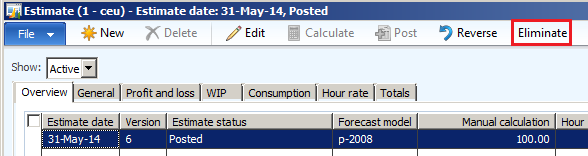

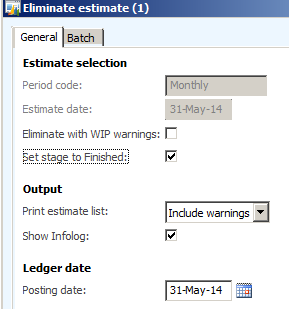

14.Eliminating the Project MANUALLY

We can estimate/eliminate the Project manually if it’s complete. After the project is completed and the percentage of completion is set to 100 percent, eliminate the estimates to clear the WIP accounts. You can do this by selecting the final estimate and clicking the Eliminate button from the Estimate form.

Create estimate by selecting below parameters

Enter % as 100

Post the Estimates and review the entries

Then eliminate to close the Project

Transactions at elimination. When the estimate project is eliminated, the WIP on-account balance account postings and the WIP sales value transactions are reversed.